In today’s Internet-driven world, almost everyone does everything online: watching movies, paying bills, keeping up with friends, and even shopping for their groceries. It’s no surprise that when people decide to buy a new home, browsing listings on the internet or mobile apps is a no-brainer. After all, if you can shop for a brand-new appliance with just a few simple clicks or taps on your phone, you can certainly figure out how to find a home online.

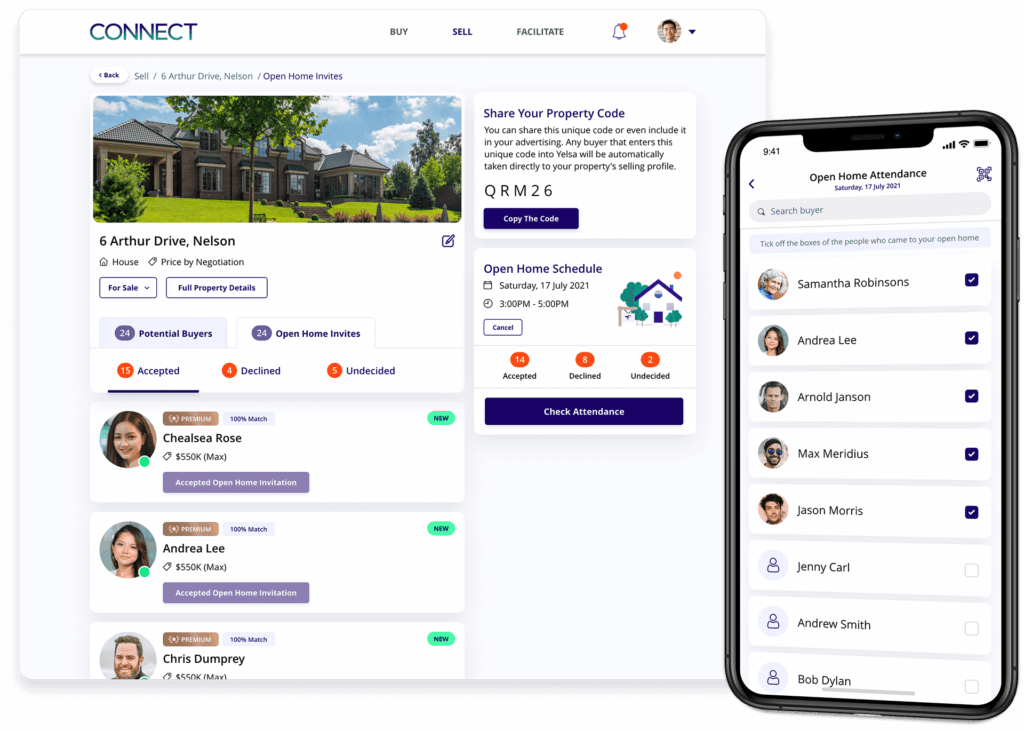

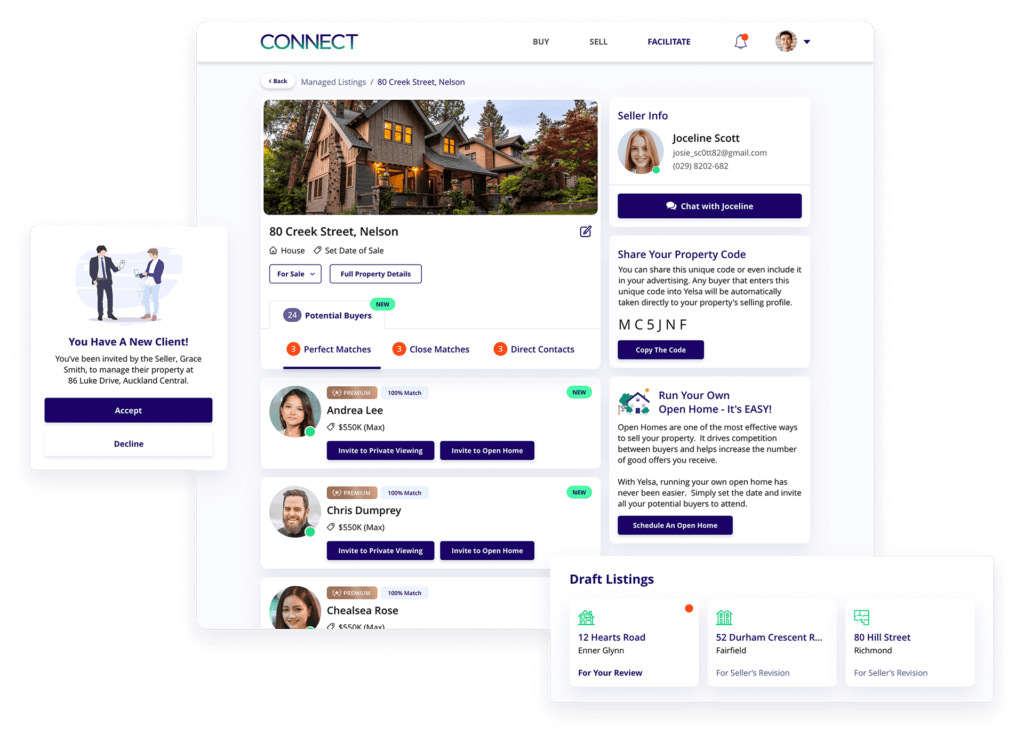

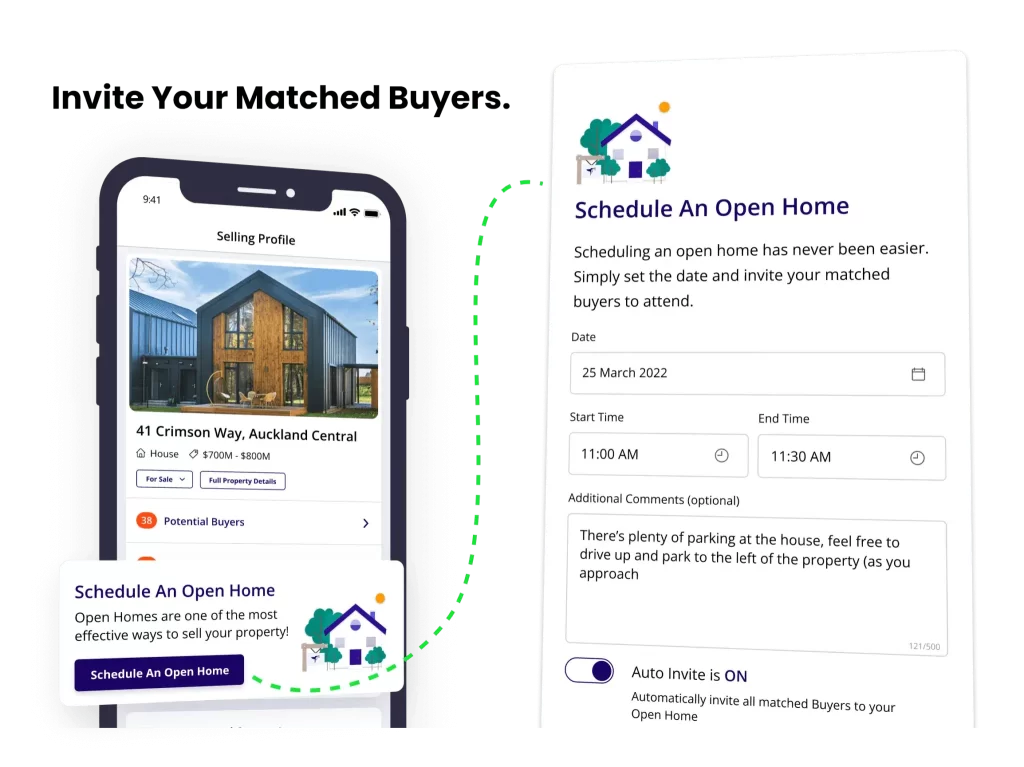

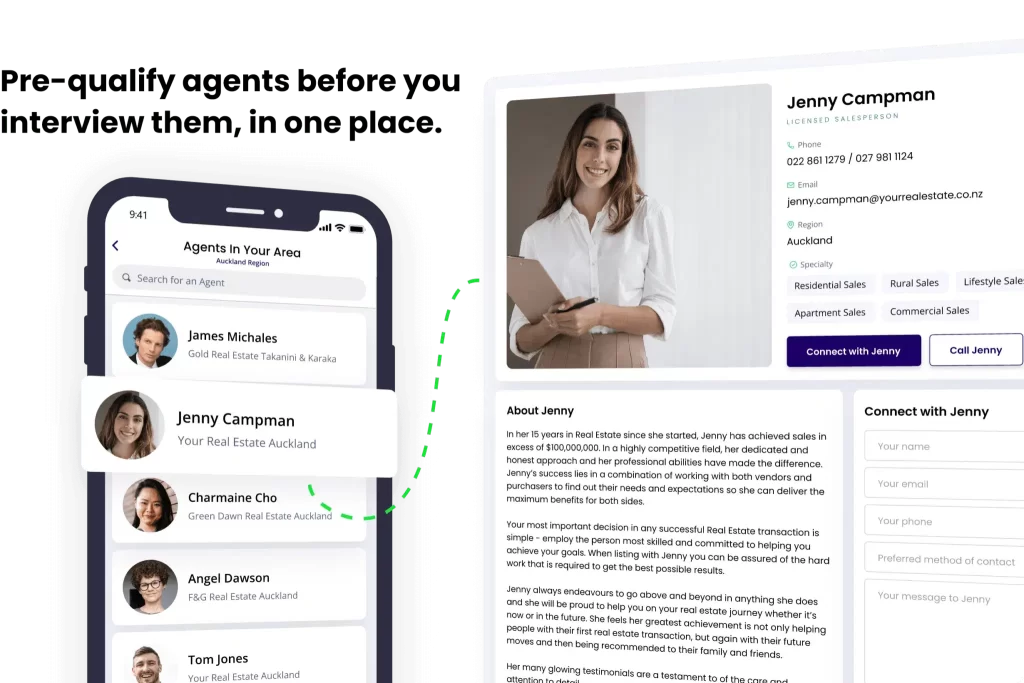

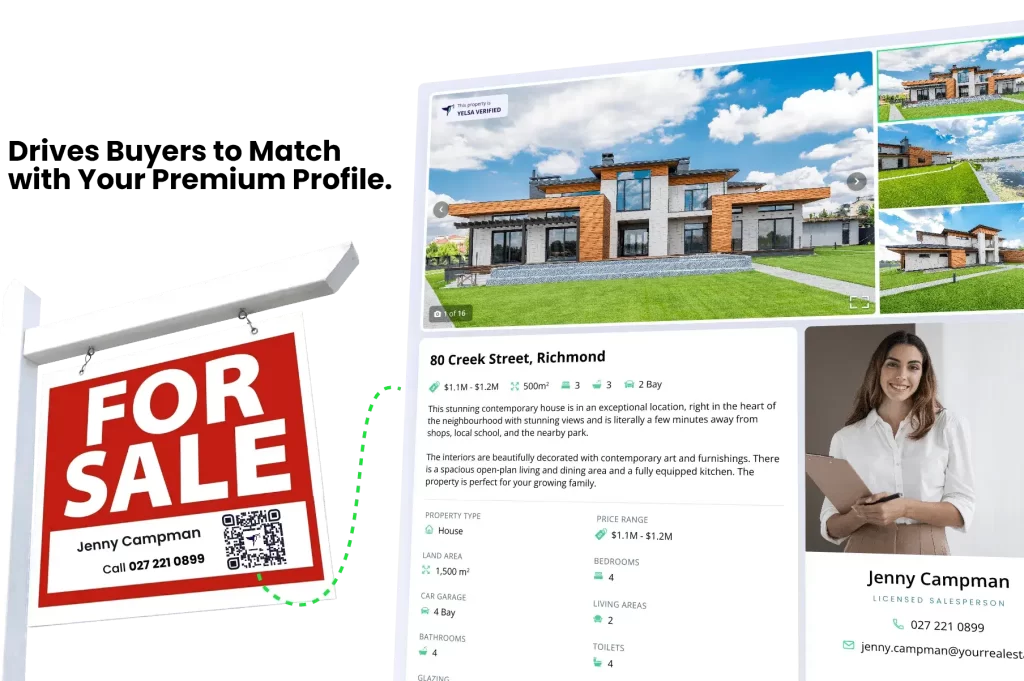

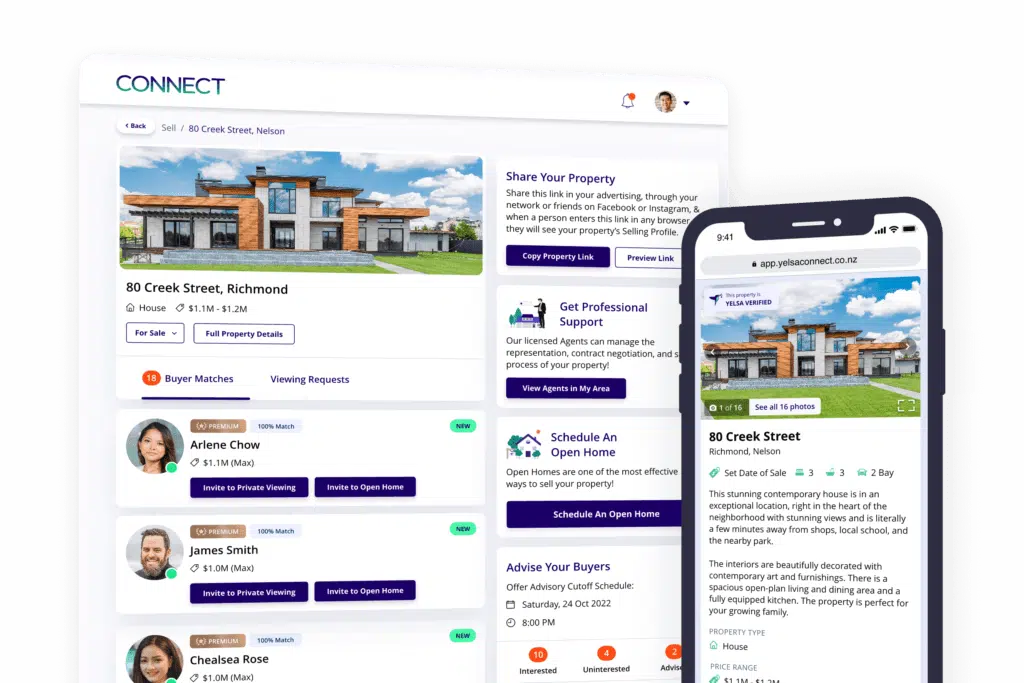

A real estate app like Yelsa Connect™ is an excellent tool that lets you receive exclusive invites to view properties even before they reach the market. In a post-COVID environment where there’s a shortage in housing, we understand how the market can be tough for Buyers. Unlike other property search sites, Yelsa Connect™ is designed to help you stand out from other buyers and receive quality invitations for properties that genuinely excite you.

What is Yelsa Connect™?

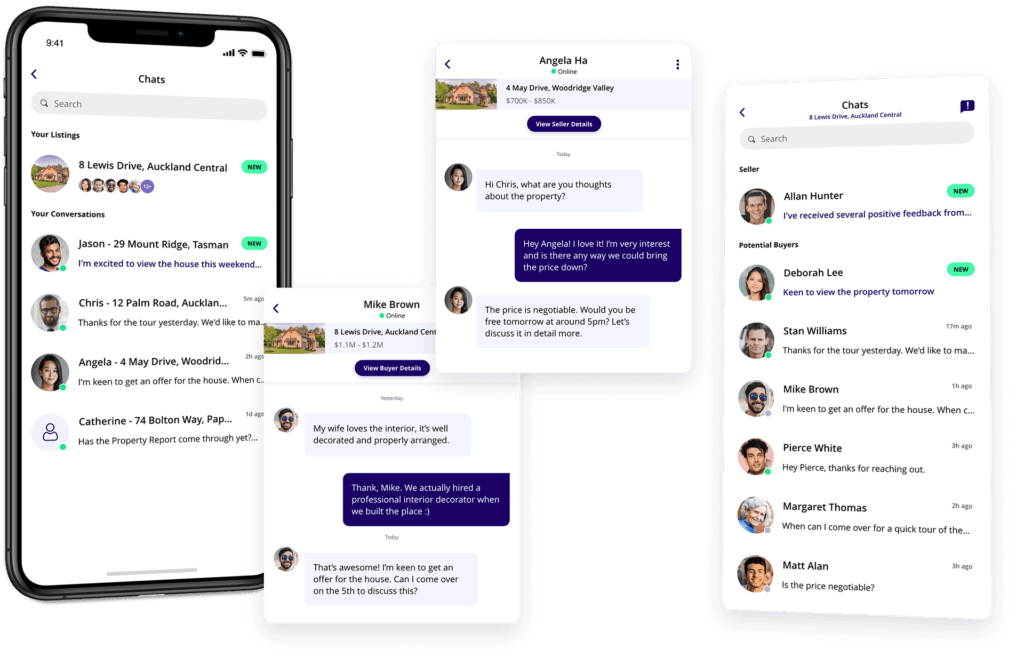

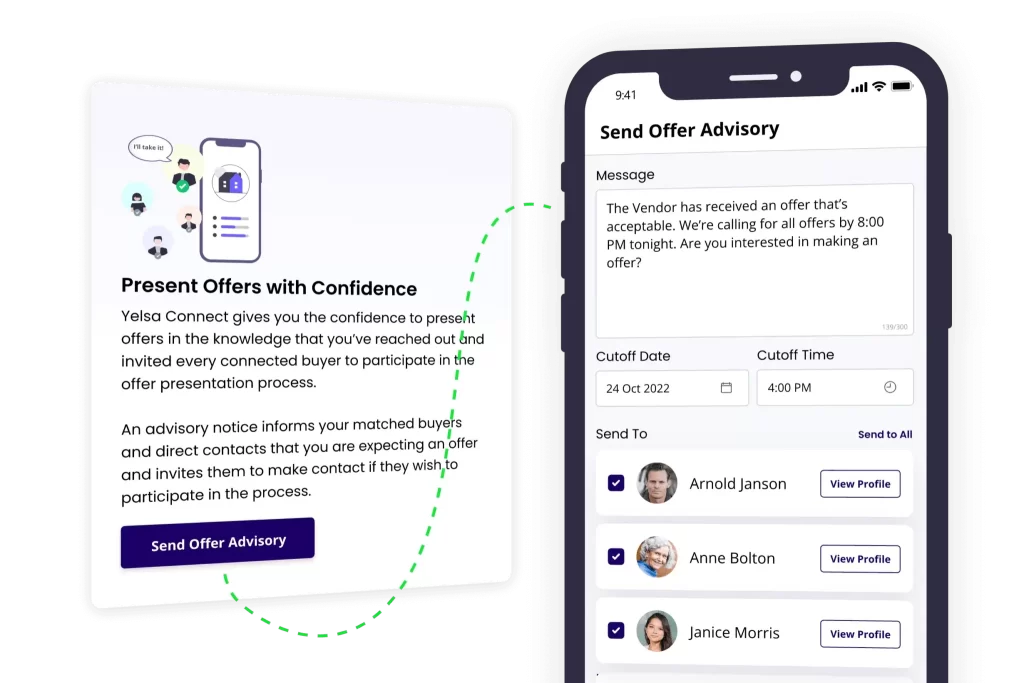

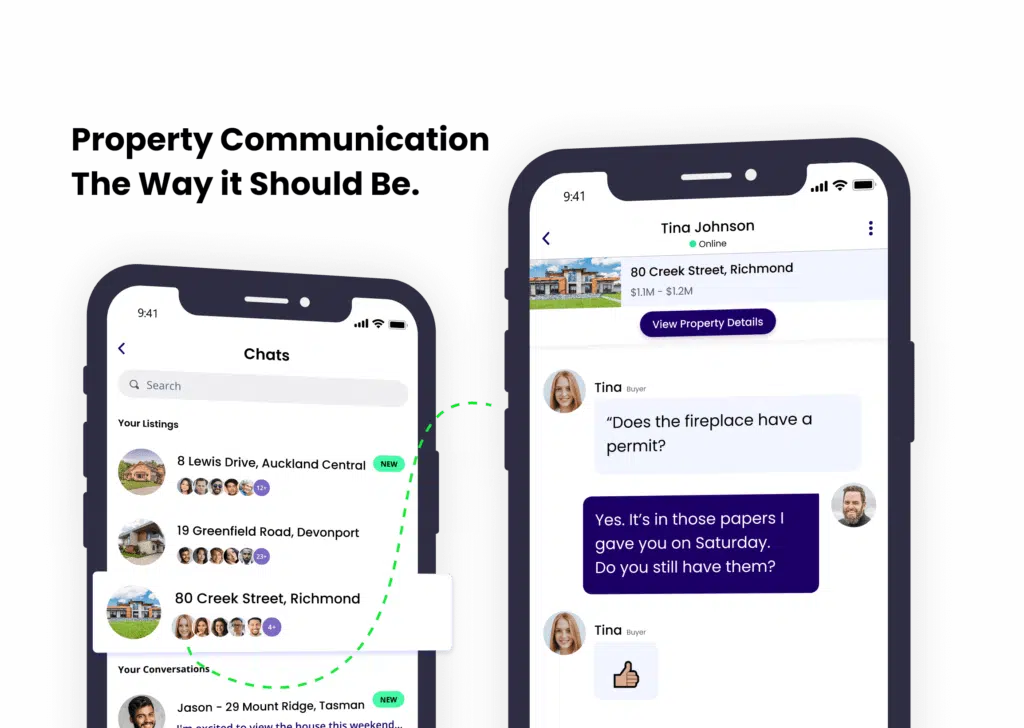

In a nutshell, think of Yelsa Connect™ as Tinder for real estate. Just like the dating app, Yelsa Connect™ lets you connect with Sellers with the perfect property, eliminating the need to go through the usual marketing channels. With the tool’s in-app messaging, you can communicate directly with the Seller and their agent – making it a streamlined, affordable system that cuts through all of the noise. In other words, property data is not spread throughout your inbox. They’re all in one, easy-to-use app.

Yelsa Connect™ is the brainchild of Mike Harvey, who has been the best real estate agent in his area for over 20 years. While online platforms have long been the preferred method of listing and searching for properties, the way people in New Zealand buy and sell homes has fundamentally remained the same. Mike Harvey is now blazing a trail to eliminate nearly all of the headaches of the buying experience with Yelsa Connect™.

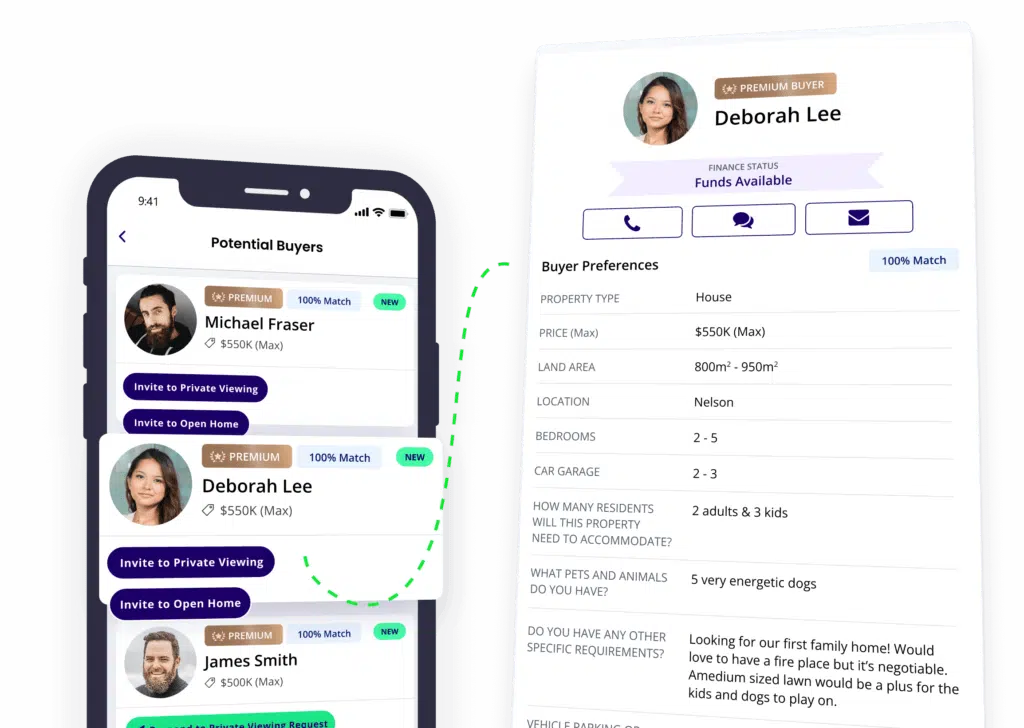

While Yelsa Connect™ is free to join, you have the option to become a Premium Buyer. The Premium Buyer mark gives your profile the significant advantage you need to stand out to home sellers. As home sellers prefer Buyers who demonstrate a genuine commitment to the buying process, you get the first invite to view new and exciting properties.

With the traditional buying methods, competition is high and so is frustration and disappointment. You could spend hours speaking to property owners and going to open homes trying to find your dream property, without finding it. Yelsa Connect™ is different. With it, you get the pick of properties before they hit the market, giving you the option to secure your dream home before anyone else. It’s great for first-time buyers still learning how to find a home online and for those seeking to purchase their dream property.

Steps to Take Before You Start Your Home Search Online

Excited to begin house hunting on Yelsa Connect™? That’s great! We’re thrilled for you too. However, if you want to learn how to find the perfect house for sale online, here are a few tips from the experts at Yelsa.

The first steps to a successful house hunt:

- Know how much you can afford. As a home buyer, there’s a lot more to think about than just the purchase price of the house. From rates and insurance to legal fees and due diligence reports, it’s best to go into house hunting open-eyed and informed about all these costs. That way, you’ll be more realistic with the type of home you can afford. The Real Estate Authority of New Zealand has a great infographic that goes into detail on the costs of owning a home.

- Save for your down payment. Most lenders require a minimum home loan deposit of at least 20% of the house price. So, for instance, if you’re buying a house worth $500,000, you’ll need to prepare at least $100,000. There are exceptions though, such as the First Home Loan Scheme, which requires a 5% deposit only. Keep in mind that the bigger your deposit, the less interest you’ll pay over the long term.

- Get a mortgage pre approval. This tells the seller you’re a legitimate buyer, signalling to them that the buy and sell process will go faster if they choose your offer. While you can submit an offer on a home you find online without a mortgage pre approval, sellers are more likely to choose you over buyers who don’t have one yet.

How to Find a House to Buy Online

Now that we’ve got those pre-house hunting steps out of the way, let’s move on to an essential part of this article: how to find a home online. Let’s walk through the process together.

Look into the history of the homes on your list

First off, it’s good to have a list of at least five favourite homes to ensure you have plenty of choices in case any contenders get snatched up by other buyers. Don’t be afraid to shop around, especially if you’re still navigating how to find a house online.

After you’ve made a list, it’s time to do your history homework and dig a little deeper into the background details of each home. Take notes about:

- Changes in price ever since the home was listed. Check for changes in the home price so that you can seal the deal with a reasonable offer.

- Homes that were recently sold in the neighbourhood. Look at neighbouring homes and see how much they’ve been sold at. Appraisers typically only look at comparable homes sold in the last three months. Get a better idea of how much a home should be in that area so you have valid points of comparison.

- Expected property taxes you will have to pay. Factor in property taxes along with any homeowner association fees. It’s also important to know if there will be construction plans around the area as those could raise your taxes.

Doing your history homework is key when you’re trying ways on how to find a house to buy online as it will help you eliminate some choices. For instance, you can decide to pass on a home in a neighbourhood with some recent foreclosures. With four homes remaining, you can narrow down your options.

Check out the neighbourhood

Even if you don’t have a family yet, finding a safe and secure neighbourhood with great schools and connectivity to life’s daily conveniences is a high priority. Check to see how each home’s neighbourhood stacks up by looking at these key factors:

- Schools. If you have kids or plan to have a family in the future, it’s always great to have quality schools nearby. The school district will also affect the value of your home when you eventually decide to sell in the future.

- Crime. Is the crime rate high in the property’s neighbourhood? Check the surrounding neighbourhoods too. After all, you don’t want to live in an area that puts you and your family at risk.

- Commute. If you regularly use public transit, are there stops nearby?

Start Your Home Search with Yelsa Connect™

Before you scour online listings for your next dream home, consider trying a new approach: download Yelsa Connect™ today. With the breakthrough app, receive exclusive invites to view properties before they reach the market and negotiate directly with Sellers.

Remember, over 30% of properties are snapped up frequently before you get to see them. Secure your dream home before anyone else seizes the chance. Sign up and discover the many benefits today! It’s completely free to join. When you go Premium, you will be a preferred match, get exclusive privileges and more.